On October 7th, Hamas, the Palestinian militant group that controls Gaza, invaded Israel by air, land and sea. Israel's Defense Minister called the incursion the worst event for Jews since the Holocaust. Over 1,300 Israelis have died including hundreds of civilians. To put this number in context, given the relative size of Israel’s population, that would equate to roughly 40,000 Americans. In response to the attack, Israel cut off electricity and the flow of food, water and supplies to Gaza. Israel also launched an air strike and is preparing a ground invasion of Gaza to eradicate Hamas that will endanger additional civilians.

This war is a tragic development and any loss of life is heartbreaking to watch. It is the latest of several geopolitical tensions to accumulate, including the Russia-Ukraine war and strained ties with China. Wars bring a significant amount of uncertainty and it is always challenging to forecast how they will impact the investment landscape. The purpose of this Investment Thoughts is to share some of our initial thoughts on the conflict. Our views are subject to change given the fluidity of the situation.

The Markets Have Remained Calm

So far, most financial markets have remained relatively calm which seems counterintuitive. This is partly because interest rates have fallen since the conflict started. This often happens when new geopolitical risks arise. They trigger flight to safety which increases demand for US Treasuries. Rising interest rates were an important reason why stock markets declined in September. Many investors also assume this war will not escalate into a broader regional conflict.

We expect market volatility to increase. Israel's Prime Minister, Benjamin Netanyahu, has vowed to destroy Hamas to ensure that Israel is safe from future attacks. As mentioned earlier, the next phase of the war is likely to be a ground invasion of Gaza. This will be complicated by the fact that Hamas has likely dispersed hostages under the city in its vast tunnel system. We should expect the death toll to increase along with more disturbing headlines, which will keep the financial markets on edge.

The Potential Impact on Oil Prices

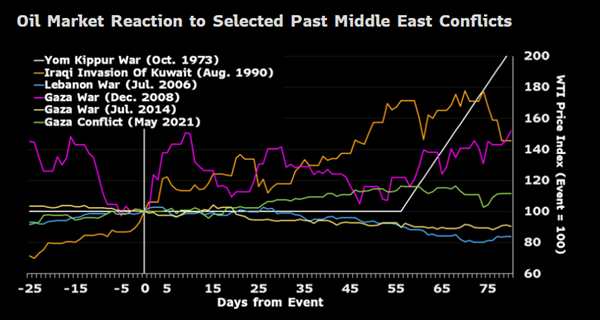

Oil prices could rise sharply if this becomes a wider regional conflict that involves a major oil producer. As shown in the chart below, oil prices rose significantly when Iraq invaded Kuwait and the Yom Kippur war led to the oil embargo. If the conflict remains contained, oil prices are likely to be more stable. That is what happened during the more limited conflicts on the chart like the Lebanon and Gaza wars.

Source: Bloomberg

Unlike the 1970s, there is little evidence that the Arab world is united in its response to the Hamas' attack. Due to the shale revolution, the US is also much less dependent on the Middle East for oil than it was then. Having said that, it will be important to monitor how other countries react to Israel’s expected ground incursion of Gaza. The world will be watching Iran closely. It has backed Hamas with funds, weapons and training in the past but denied involvement in the recent invasion of Israel. There are reports that Iran is speaking with other Middle East countries to rally support for the Palestinians. If Iran becomes involved in the war, it has the power to shut down the Strait of Hormuz and the 20% of global supply that flows through it.

Geopolitical Risks Have Increased

This conflict is part of a broader shift to a secular environment of higher geopolitical risks. The world order is changing leaving a backdrop that is less stable. During the past several decades we enjoyed a unipolar backdrop where the US dominated. Power has since become more evenly distributed among several countries. The Israel-Hamas war may seem isolated, but it has the potential to further erode the interconnectedness that remains among the world’s largest economies. The United States benefited from the globalization trend that ramped up in the latter half of the 20th century. The reversal of this trend has many implications. For example, it raises costs putting upward pressure on inflation.

Stepping Back for Perspective

Geopolitical events like the Israel-Hamas war garner a lot of media attention. Disturbing headlines elicit many emotions from anger to despair to fear. It is hard for us as human beings to watch so many people suffer. These events often cause investors to make impulsive emotionally driven investment decisions. It is important to maintain perspective and remember the markets usually take geopolitical events in stride. We looked back at the last 19 historical events dating back to 1940. They included Pearl Harbor, Iraq’s invasion of Kuwait, the Asia Financial Crisis, and Brexit. Despite the severity of these events, the US stock market was up two-thirds of the time after 250 days. The market increased an average of 4% for all events.

Stay Focused on Fundamentals

During periods like this, it is crucial to stay focused on the fundamentals that drive long-term returns. They include factors such as the business cycle, the direction of corporate earnings, inflation, and interest rates. The US economy has proven more resilient than many expected coming into the year, inflation has moderated, and the Federal Reserve may be nearing the end of its tightening campaign. While these are positive factors, we need to monitor other important risks like the lagged impact of the Fed’s actions on the economy and our country’s rising debt burden.

I should mention that we stress tested our equity strategies last week. We wanted to see how they would perform during an oil shock such as the one that occurred in 2011 due to the civil war in Libya. Although we were pleased with the results, we will do further analysis on our portfolios this week. Looking for ways to improve portfolios is a continuous process. In an uncertain world, we believe diversification across asset classes and geographical regions is as important as ever.

As always, please contact your wealth management team if you have any questions or would like to discuss your portfolios in more detail. You may also reach out to me directly. My contact information is listed below.

Douglas B. Phillips, CFA

Chief Investment Officer

douglas.phillips@ledyard.bank