The spreading coronavirus (COVID‐19) has taken the world by surprise and has led to significant market volatility. We are sending you this letter because we wanted to share our thoughts.

The US stock market is off 15% from its highs and is back to where it traded last fall. The decline accelerated as it became apparent that the coronavirus was spreading beyond China to countries such as Japan, South Korea, Italy and Iran. This increases the probability it will become a pandemic. The medical community does not know how severe this epidemic will be. It is also difficult to gauge its ultimate impact on global economic activity.

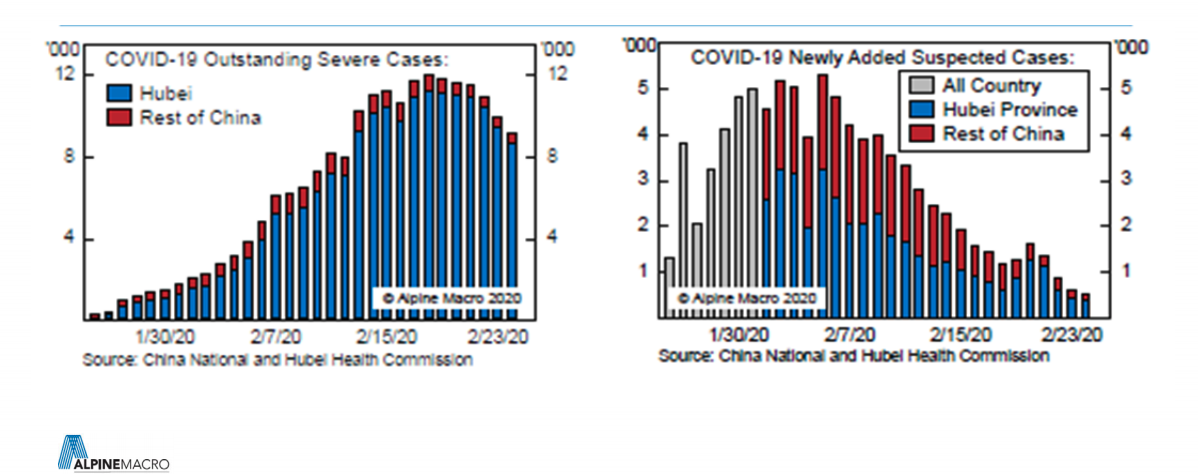

While there is a sea of negative headlines, it is worth considering a few positives. As the charts below show, it appears that China is starting to get the coronavirus under control in Hubei, where it originated. It also appears that it has not spread to the rest of China in a meaningful way. This shows that the coronavirus does eventually peak and recede. It will take some time for economic activity to return to normal but China’s central bank, along with many others, will provide liquidity and stimulus to try to reduce the impact. When an event of this nature occurs we all tend to think of our loved ones, particularly our children. The mortality rate is currently in the low single digits and even lower for children. Other epidemics such as SARS and MERS had mortality rates 10% or higher.

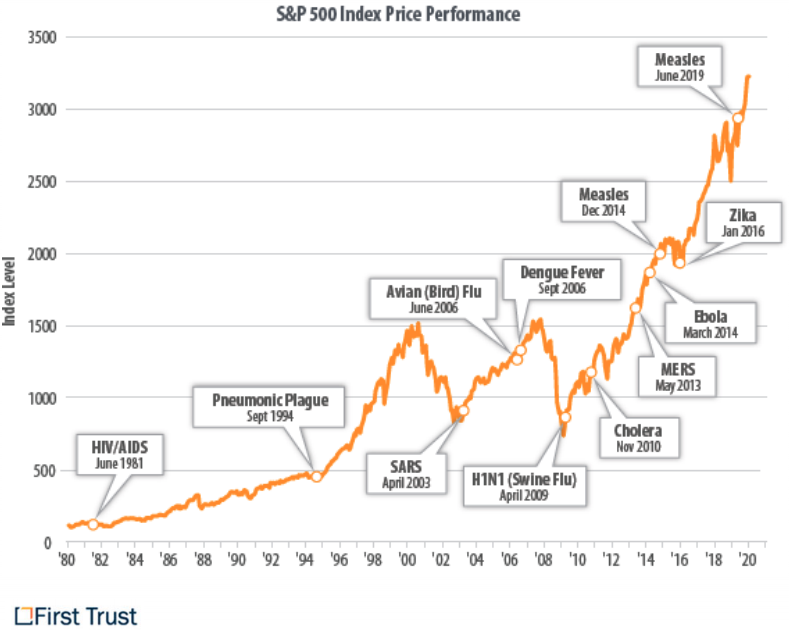

While it is impossible to know exactly how this event will impact the markets, we can look to the past for some guidance. The following chart plots past epidemics on a chart of the S&P 500 Index (US stocks). It shows that although epidemics are always scary, and sometimes coincide with a down market, they generally are not the cause of major bear markets. While this provides some solace, we are nevertheless taking this outbreak very seriously and monitoring it closely.

It is important to remember that market sentiment always swings back and forth like a pendulum ‐ from optimism to pessimism and back again. Most investors entered 2020 optimistic as trade tensions had faded somewhat and economic news had improved. They had also watched the US market appreciate over 30% in 2019. Positive sentiment like this often sets the stage for periods of heightened volatility when unexpected events upset the common narrative. This is one reason why the reaction to the coronavirus has been so sharp. Investors are now swinging to a more negative mindset. This will eventually set the stage for positive surprises.

When events like this occur, we are often asked how we plan to react to the sharp increase in volatility. Our answer is that it is important to stay disciplined and avoid making hasty decisions that could backfire later. Our preparations started long before the coronavirus became a problem. We did not predict this event. As the economic and market cycle grew longer, however, we took steps to mitigate risk by improving the quality of your stock and bond holdings. Episodes like this can also provide us with attractive opportunities. We routinely identify quality investments that we pass on because they are too expensive. Now that prices have pulled back, we are revisiting some of these ideas.

During periods of uncertainty such as this, it is important to remain focused on the long‐term and the plan we developed with you. Diversification was part of that plan. While stock markets are retreating, bonds are performing well. From a portfolio standpoint, this partially offsets the weakness in stocks. Diversification is working as it should.

We will continue to closely monitor developments as they unfold. As always, we encourage you to call any member of our team if you have any questions or would like to discuss our investment strategy in more detail. We are here to help.

Douglas B. Phillips, CFA

Douglas B. Phillips, CFA

Chief Investment Officer

douglas.phillips@ledyardbank.com

This communication is intended to be strictly informational. Exclusive of our client relationships, it is not intended to be, nor does it constitute an offer to sell or a solicitation of an offer to buy any securities referenced. Information contained herein has been obtained from sources that are believed to be reliable, but its accuracy and completeness cannot be warranted or guaranteed.

Non-deposit investment products are not insured by the FDIC, are not deposit or other obligations of, or guaranteed by the bank or any affiliate, and are subject to investment risk including the possible loss of principle amount invested.

Ledyard National Bank. All rights reserved.